Securities Clearing Service

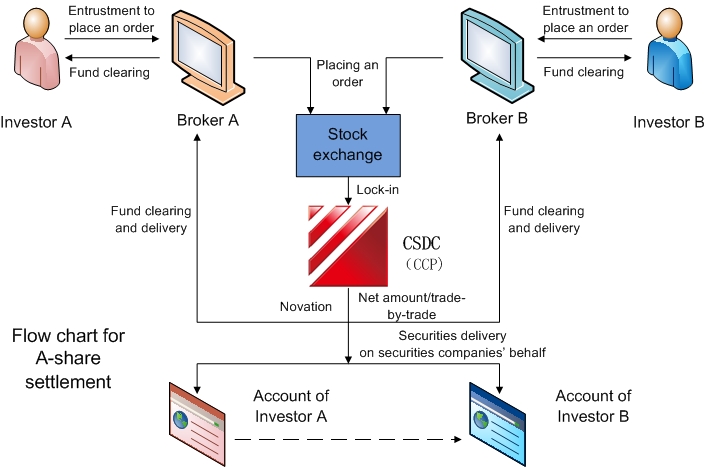

The securities clearing service is a post-transaction service. Essentially it is the process by which both parties to a transaction determine the amount of money or securities that should be paid and consequent settlement process. Through the securities clearing process, the buyer obtains the securities, and the seller receives money. The clearing service includes clearing and settlement. Clearing is the process of calculating the amount of securities and capital that should be received and paid by the two parties on the clearing date according to the results of the securities transaction. Settlement is the process of organizing the two parties in delivering the securities and capital payment according to the results of the clearing.

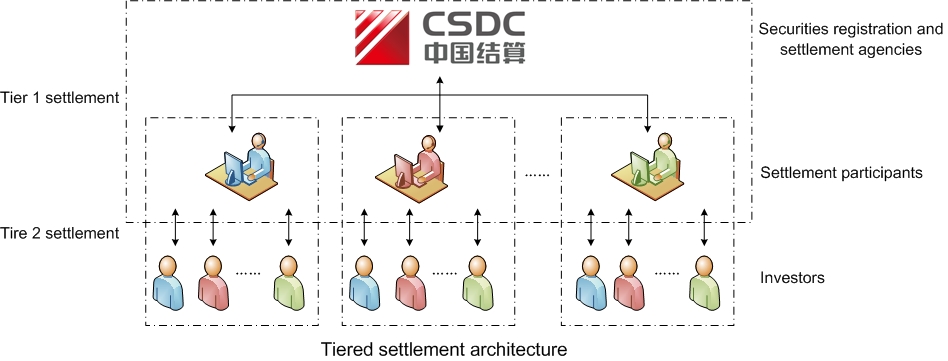

In practice, CSDC conducts securities clearing in line with the tiered clearing principle, as shown in the following figure. The tiered clearing principle means that CSDC does not directly participate in securities clearing services for ordinary investors. Instead, it is responsible for collective clearing and settlement with clearing participants (such as securities companies, custodian banks and other institutions) and completes tier 1 clearing and settlement of securities and capital. The clearing participants are responsible for clearing and settlement with their clients, and they complete tier 2 clearing and settlement of securities and capital. They entrust CSDC with the transfer of securities.

CSDC divides settlement into unsecured settlement and secured settlement. Unsecured settlement means that the settlement of securities and capital with the clearing participants is completed in its gross amount and trade by trade. If any clearing participant breaches a contract, the other clearing participant must assume the default risk of the counterparty, and the settlement process is terminated. The two parties must solve the issue on their own, and CSDC will not assume any default liabilities. Securities transactions adopting unsecured settlement include primary market issuance transactions, outright repo buy-back transactions and warrant executions.

Secured settlement means that CSDC completes the securities and capital settlement with each clearing participant in a multilateral netting mode. In this process, CSDC serves as not only the market organizer, but also the central counterparty (CCP). It becomes the seller for the buyer and the buyer for the seller and assumes the responsibility for guaranteeing the settlement. If any clearing participant breaches a contract, CSDC will still fulfill the settlement liability to the non-defaulting clearing participant. Securities transactions adopting secured settlement cover most of the second tier market transactions (including A shares, B shares and closed-end funds) and open-end fund subscription and repurchase transactions.

At present, the settlement period for A share transactions is T+1. That is, for an A share transaction completed on day T (transaction date), the settlement is finished on the next transaction date. The settlement period for B share transactions is T+3.

To better ensure the smooth and safe operation of the securities clearing business, CSDC has set several clearing rules and principles in addition to the tiered clearing principle.

(I) Netting and Delivery Versus Payment (DVP) Principle. CSDC uses a netting mode in secured settlement. It performs a netting operation on the securities/capital receivables/payables of the clearing participants to calculate the net amount of the securities/cash receivables/payables. When the clearing participant delivers the cash or securities that it is contract-bound to pay, CSDC provides it with the corresponding securities or capital.

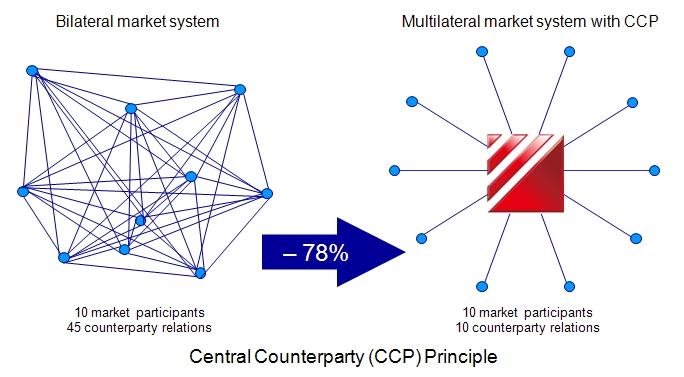

(II) Central Counterparty (CCP) Principle. In this clearing process, CSDC gets involved in the securities transaction and becomes the settlement counterparty of all the buyers and sellers to ensure the successful completion of the settlement. The CCP principle helps simplify the clearing process and improve efficiency. At the same time, CSDC can manage collectively the credit risks of counterparties in the market according to clearing and settlement business rules, which is conducive to controlling and reducing the overall market risks. As shown in the following figure, when there are 10 participants in the market, there are altogether 45 counterparty relations. If CSDC acts as the CCP, only 10 counterparty relations are needed, and the number of counterparty relations can be downsized by 78%.

Print

Print Close

Close